As we approach 2025, the question of whether to rent or buy continues to evolve in importance. With economic shifts, changing consumer preferences, and new market trends, it’s essential to understand how renting and buying compare today. Whether you're deciding whether to rent or buy a house, a car, or equipment, this blog provides insights into renting trends in 2025, the cost comparison of renting vs buying, and the financial impacts of renting and owning in the current market.

Should I Rent or Buy in 2025?

The traditional decision to buy or rent is not as straightforward as it once was. Renting vs buying a home or any other asset depends largely on your unique financial situation, goals, and long-term plans. With inflation, high property costs, and the growing subscription economy, many people are rethinking their approach to ownership.

Key Factors to Consider in 2025:

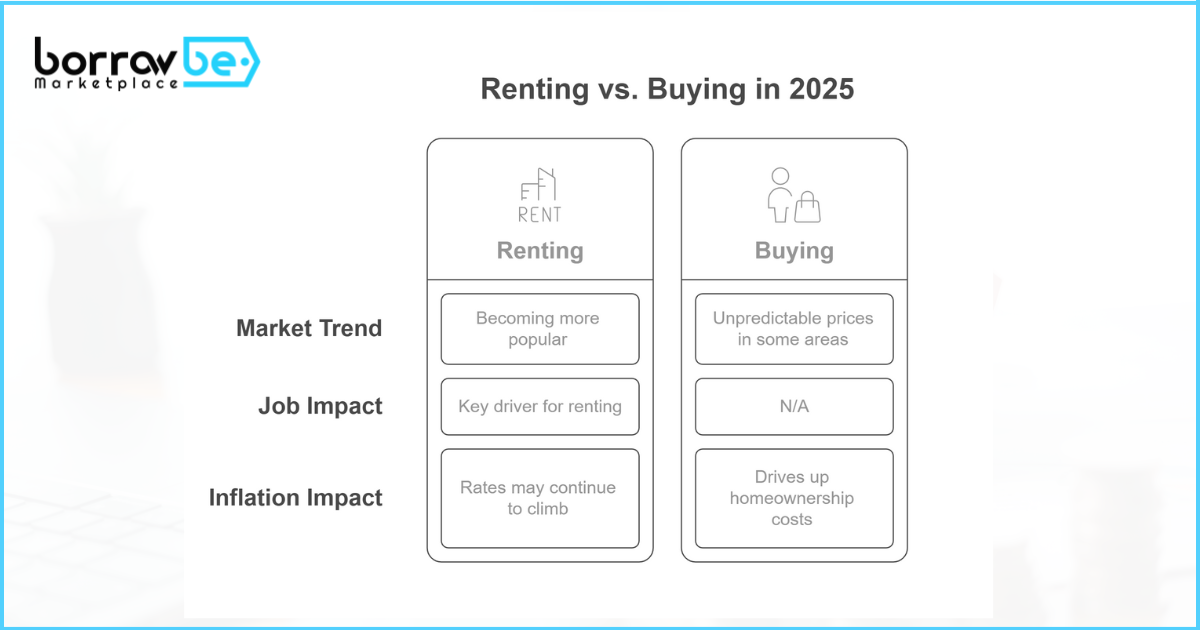

- Real Estate Trends: The housing market in 2025 continues to be unpredictable. While some areas are seeing soaring home prices, others are becoming more renter-friendly as remote work and flexibility influence location choices.

- Job Mobility: The rise of digital nomad renting means many are opting to rent their homes, vehicles, and equipment rather than commit to a long-term purchase. This flexibility is one of the key drivers behind renting trends in 2025.

- Inflation Impact: In times of economic uncertainty, inflation can drive up both rental rates and homeownership costs. Deciding between renting vs buying can have a significant impact on your budget, as rents may continue to climb.

Financial Impact of Renting vs Buying

Understanding the financial impact is a key component of the decision-making process. Renting advantages include lower upfront costs and fewer responsibilities, but it also means no building of equity. In contrast, buying a property allows you to build equity over time, but comes with higher upfront costs like down payments and mortgages.

If you're interested in a deeper dive into the financial aspects, check out Borrowbe’s FAQ page for more insights into financing and renting. You can also read about how to rent out underutilized assets and earn passive income, which could help finance your home or other asset purchases.

Pros and Cons of Renting vs Buying

Let’s break down the benefits and drawbacks of renting versus buying in 2025.

Pros of Renting:

- Flexibility: Renting offers the ability to move frequently without being tied down by property ownership.

- Lower Upfront Costs: Renters only need to pay a security deposit, while homeowners face hefty down payments, closing costs, and mortgages.

- No Maintenance Costs: Renters aren't responsible for repairs, maintenance, or property taxes, which can be a burden for homeowners.

Cons of Renting:

- No Equity Building: Rent payments contribute to someone else’s wealth rather than your own.

- Limited Control: Renters face restrictions on making changes to their living space and can face rent increases.

- Potential for Higher Costs: In high-demand areas, rent can increase significantly over time, making homeownership an appealing option.

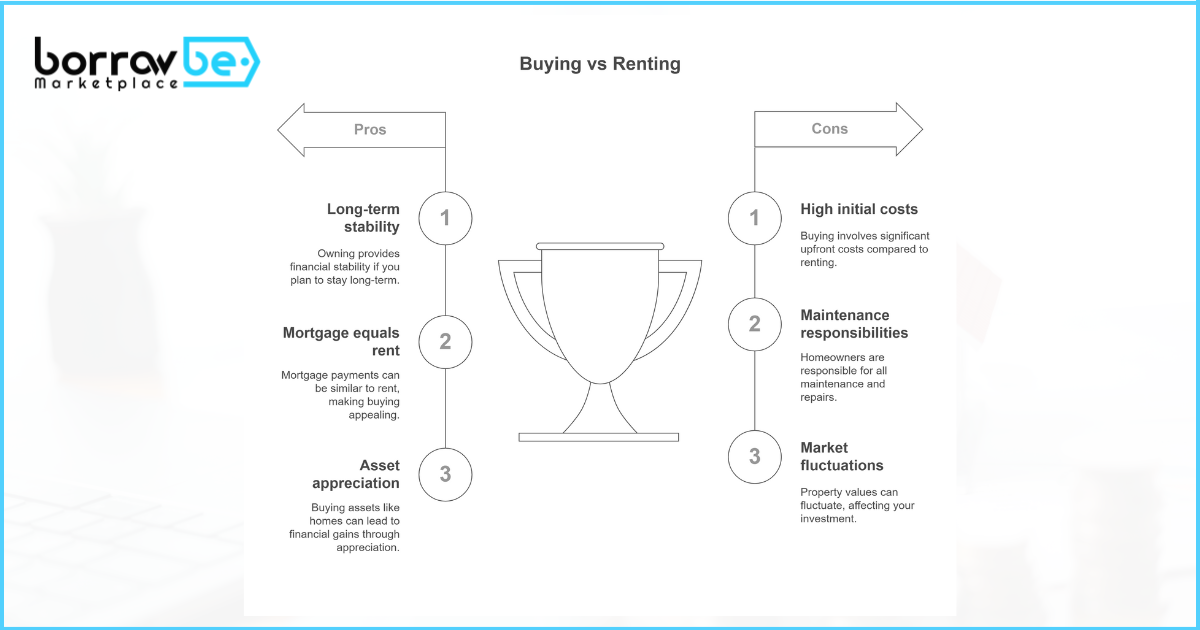

Pros of Buying:

- Building Equity: Mortgage payments contribute to ownership, building equity in your property.

- Stability: Owning a home offers long-term stability, both financially and in terms of your living situation.

- Customization: Homeowners have the freedom to remodel and make improvements to their property as they see fit.

Cons of Buying:

- Upfront Costs: The initial costs of buying a home, including down payments and closing fees, can be substantial.

- Ongoing Maintenance: Homeowners are responsible for repairs, maintenance, and property taxes.

- Risk of Depreciation: There is a risk that the value of your property could decrease, particularly in fluctuating markets.

Cost Comparison Rent vs Buy

A rent vs buy calculator can help you assess whether buying or renting is more cost-effective based on your financial situation. Tools like these take into account the upfront costs of buying a property, monthly mortgage payments, and potential increases in property value.

When considering whether to rent or buy in 2025, you need to evaluate:

- Upfront expenses (down payments vs. security deposits)

- Ongoing costs (mortgage payments vs. rent)

- Potential for appreciation or depreciation

By analyzing these factors, you’ll get a clearer picture of what makes more sense for you financially.

Renting Trends in 2025

Renting is not just limited to homes anymore. With the growing shared economy, people are more inclined to rent a variety of assets instead of buying them outright. Here are some key renting trends in 2025:

1. Subscription Economy

The shift toward a subscription economy is reshaping how we think about ownership. Many services now offer flexible leasing options for cars, electronics, and even homes. This flexibility allows consumers to rent or lease items on a short-term basis, without committing to long-term ownership.

For instance, you can look at Borrowbe’s mission for a better understanding of how renting out underutilized assets can benefit you, both financially and personally. It’s all about maximizing value through access instead of ownership.

2. Urban Renting Trends

Urban areas are seeing more individuals opting for short-term rental benefits. In cities with high living costs, it’s becoming more affordable to rent a property rather than buy one. As urban spaces become more transient, renters enjoy the flexibility of moving without the burden of long-term financial commitments.

3. Corporate Leasing Trends

Businesses are also jumping on the renting bandwagon, with an increasing trend in corporate leasing. Companies prefer renting office space, equipment, and even housing for employees, providing more flexibility in their operations. Explore the Renting vs. Leasing blog on Borrowbe to understand the key differences between these options and find the best solution for your company.

4. Generational Renting Habits

Millennials and Gen Z are leading the charge in generational renting habits. Economic pressures such as student debt, rising living costs, and the desire for flexibility have made renting more attractive than buying. Rent-to-own options are becoming more popular, providing an avenue for these generations to transition from renting to ownership.

When to Buy Instead of Rent

There are times when buying makes more sense than renting. If you’re in a stable situation with a long-term plan, buying can be a better financial move.

Consider buying if:

- You plan to stay long-term: If you’re settled in one location, owning may offer more financial advantages.

- Rent is as high as mortgage payments: In some cities, mortgage payments are comparable to rent prices, making homeownership an attractive choice.

- Asset Depreciation Concerns: If the asset is expected to appreciate, like a home or collectible, it may be more beneficial to buy than rent.

The Future of Ownership

In the coming years, ownership will likely evolve to meet the demands of a changing economy. More people are likely to explore rent-to-own options, allowing them to rent before committing to purchasing a property. As a result, owning property may no longer be the automatic goal for many consumers.

In addition, the shared economy growth will continue to impact purchasing decisions, especially as more people seek to rent or lease products instead of owning them outright.

As sustainable consumption becomes a priority, people will seek ways to reduce their environmental impact, often choosing to rent or lease items rather than purchase them. This mindset aligns with the growing importance of digital nomad renting, where flexibility and environmental impact are prioritized over traditional homeownership.

Conclusion

The decision of whether to rent or buy in 2025 depends on your unique circumstances, goals, and the market conditions where you live. While renting offers flexibility, lower upfront costs, and fewer maintenance responsibilities, buying offers long-term financial benefits and stability. By considering the cost comparison rent vs buy and understanding renting trends in 2025, you can make an informed decision that best aligns with your future goals.

For further guidance, check out Borrowbe’s rental property listings and use their tools to see how renting out assets can offer you steady passive income, helping you make the financial decisions that suit you best.