Leasing heavy-duty or agricultural equipment can be a cost-effective solution for businesses and individuals seeking flexibility without the upfront costs of ownership. In fact, platforms like BorrowBe offer valuable tools and resources to help you navigate your options, while this guide walks you through the process, ensuring you make informed decisions and optimize your financial and operational outcomes.

Introduction to Leasing Heavy-Duty and Agricultural Equipment

Leasing has become a popular alternative to purchasing equipment, particularly in industries like construction, farming, and logistics. According to the Equipment Leasing and Finance Association (ELFA), the U.S. equipment leasing industry generated over $1 trillion in 2022, highlighting its critical role in modern business operations.

For agricultural enterprises, leasing offers access to advanced machinery like tractors or harvesters without the burden of long-term debt. Similarly, construction firms benefit from leasing bulldozers or cranes for project-specific needs. Platforms like BorrowBe simplify this process by connecting lessees with verified equipment owners, ensuring transparency and reliability.

Understanding the Basics: Leasing vs. Buying

Key Differences Between Leasing and Purchasing

Leasing involves paying for equipment use over a fixed term, while buying requires full ownership upfront. Leasing preserves capital, offers tax benefits, and allows upgrades to newer models, whereas purchasing builds equity but ties up funds.

Financial Implications

A 2023 IBISWorld report found that 65% of small-to-medium enterprises prefer leasing for its cash-flow advantages. Leasing payments are often tax-deductible as operating expenses, whereas purchased equipment depreciates over time.

|

Factor |

Leasing |

Buying |

|

Upfront Cost |

Low or $0 |

High |

|

Tax Benefits |

Deductible payments |

Depreciation deductions |

|

Flexibility |

Upgrade options |

Permanent ownership |

|

Maintenance |

Often included |

Owner’s responsibility |

Assessing Your Equipment Needs

Identify Project Requirements

Evaluate the scope, duration, and type of projects. For example, a short-term road construction job may require a bulldozer for three months, while a farming operation might need a combine harvester seasonally.

Budget Considerations

Determine your monthly leasing budget, including potential maintenance and insurance costs. Use BorrowBe’s search tools to compare rates for equipment like Construction Machinery or Agricultural Tools.

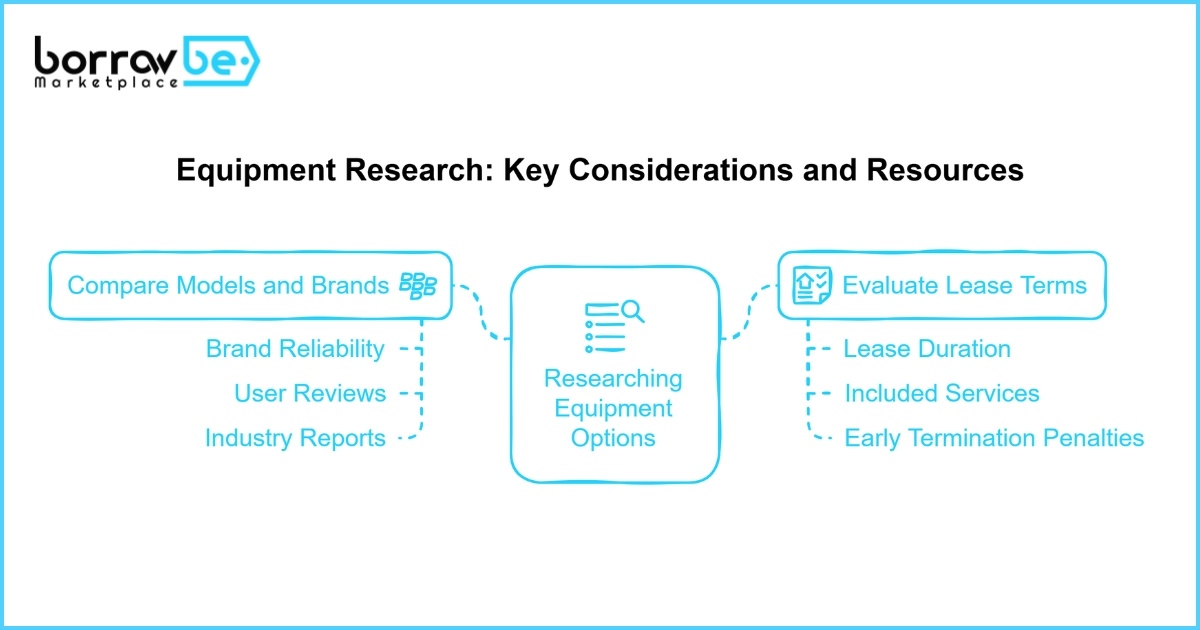

Researching Equipment Options

Compare Models and Brands

Prioritize reliability and efficiency. John Deere and Caterpillar dominate agricultural and construction markets, respectively, due to their durability. Check user reviews and industry reports for performance insights.

Evaluate Lease Terms

Look for:

- Lease duration (short-term vs. multi-year).

- Included services (maintenance, repairs).

- Penalties for early termination.

Platforms like BorrowBe allow users to filter listings by these criteria, ensuring tailored matches.

Choosing the Right Leasing Partner

Verify Credibility

Ensure lessors are licensed and insured. BorrowBe’s verified listings, such as those under Car for Lease or House for Rent, provide transparency through user ratings and reviews.

Negotiate Custom Terms

Discuss flexible payment schedules or mileage limits. According to leasing expert Maria Gonzalez, “Negotiating maintenance inclusions can reduce unexpected costs by 30%.”

Reviewing Lease Agreements Thoroughly

Key Clauses to Inspect

- Termination Conditions: Understand penalties for early returns.

- Insurance Requirements: Confirm coverage for damages or theft.

- Renewal Options: Secure favorable terms for extending leases.

Seek Legal Advice

A contract attorney can clarify jargon and ensure compliance with local regulations.

Managing Costs and Budgeting

Avoid Hidden Fees

Common hidden costs include delivery charges, late fees, and excess usage penalties. Budget 10–15% extra for contingencies.

Track Expenses

Use tools like QuickBooks or BorrowBe’s app to monitor payments and deadlines.

Maintaining Leased Equipment

Follow Manufacturer Guidelines

Adhere to service schedules to avoid voiding warranties. For example, excavators need hydraulic fluid checks every 500 hours.

Document Maintenance

Keep records of all repairs and inspections. BorrowBe’s partners often include digital logs for streamlined tracking."

Maximizing Financial Flexibility

Leverage Upgraded Technology

Swap outdated models for newer ones to boost productivity. Leasing enables access to innovations like GPS-guided tractors or electric excavators.

Monetize Idle Assets

Owners can Turn Your Assets Into Income by listing unused equipment on BorrowBe.

Handling End-of-Lease Options

Purchase, Return, or Renew

Evaluate residual value vs. market price if buying. For returns, ensure equipment meets lessor’s condition standards.

Plan Ahead

Start negotiations 60–90 days before lease expiration to secure better terms.

FAQs

Is leasing better than buying for short-term projects?

Yes, leasing minimizes upfront costs and eliminates long-term commitments. Platforms like BorrowBe offer flexible terms for seasonal needs, such as Vacation Rentals or short-term machinery leases.

What credit score is needed to lease equipment?

Most lessors require a score of 650+. However, BorrowBe connects users with lenders offering flexible credit options, especially for agricultural SMEs.

Can I negotiate maintenance in my lease?

Absolutely. Many agreements include maintenance packages, reducing downtime. Always confirm service coverage before signing.

How do I avoid excess usage fees?

Track equipment hours/mileage diligently. Use apps like the BorrowBe App for real-time monitoring.